Amazon Black Friday and Cyber Monday 2022: PPC Report

Whether you took part in Amazon Black Friday and Cyber Monday sales or not, you probably want to know how consumers and your competition behaved in 2022.

The insight into consumer behavior and Amazon sellers’ actions and advanced Amazon PPC strategies can give you an edge when planning for upcoming sale events in 2024!

We drew the observations explained in this article from a large data pool of our Amazon customers who have agreed to an anonymized analysis of the tendencies around global sales events.

Black Friday 2022 was held on 25 November and Cyber Monday on 28 November. To analyze both sales events we took into account the data from 1 November to 6 December to get an appropriate insight into behavior before, during and after Cyber Week.

First, let’s dive into consumer behavior and then have a closer look at what Amazon FBA sellers, FBM sellers and vendors were up to during Cyber Week!

Cyber Week’s Consumer Behavior

In the face of inflation-related shifts, lots of Amazon sellers, vendors and eCommerce business owners were unsure how Amazon Black Friday and Cyber Monday sales will go in 2022.

Short Preface: 2022 Sale Events

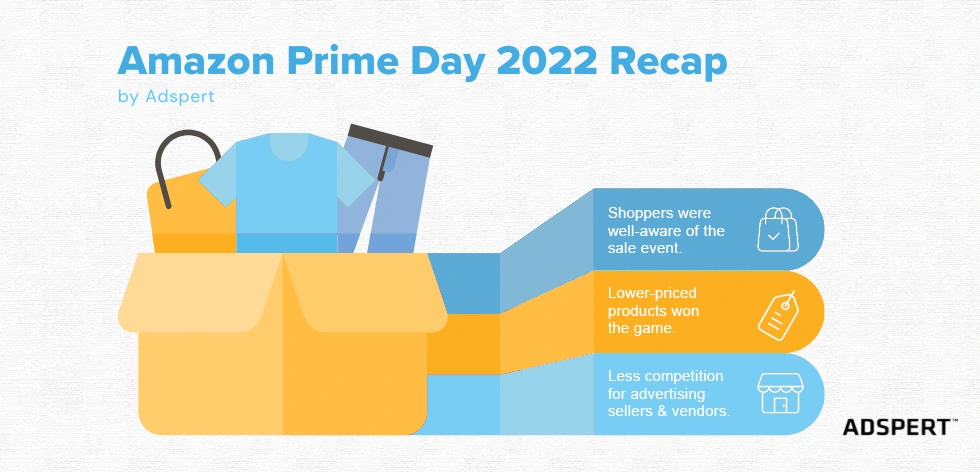

Earlier the same year in July, Amazon Prime Day 2022 broke the record with more than 300 million sold products.

After an extremely successful sales event, many experts were speculating if Amazon will organize another Prime Day (which has already happened in the past!).

Sales numbers were soaring, but the global economic situation wasn’t the best. It was anyone’s game at that point. In September 2022 the guesswork was over: Amazon announced the second Prime Day, the so-called Prime Day Early Access sale that was on 11-12 October.

How did it go? In short: it’s not a secret that Prime Day in October did not perform at the level of July’s Prime Day.

The bottom line is that based on both Prime Day results no one could really say for sure how Amazon Black Friday and Cyber Monday would go.

Amazon Black Friday and Cyber Monday or Buy, Buy, Buy!

After Cyber Week’s dust settled it is now clear: people didn’t care about the looming recession and spent a record amount!

The best part? They even bought products that are on average 4% higher priced.

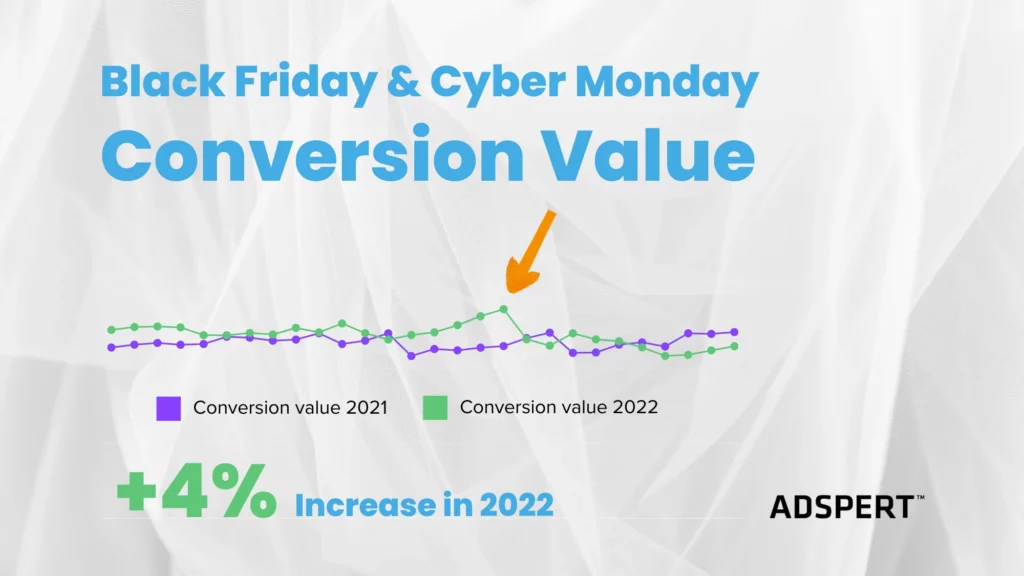

We take data seriously and wanted to double-check the higher average product price. We had a look at the conversion value and there it was: the conversion value increased by 4% as well.

- 2022: 24.5€ → +4%

- 2021: 23.5€

For even more information, you can also check out key learnings from 2022 holiday shopping season by Amazon. It serves data only for the US, but it lists the best-selling categories and best-selling products which can provide you with valuable insights.

And that wraps up the spenders’ behavior for 2022 Amazon Black Friday and Cyber Monday. Shoppers were more than ready to shop and they were even willing to splurge on more expensive products than last year!

Pro Tip

Don’t miss any sales opportunities this year! Check out our FREE retail calendar 2024.

Black Friday Stats for Amazon Sellers and Vendors

Allocating the pay-per-click advertising (PPC) budget is often tough for even the most experienced sellers. There are sooooo many variables that you can’t affect.

How can you make the most informed decision in such uncertain circumstances? By arming yourself with information!

Here’s what we uncovered about Black Friday eCommerce trends and Amazon PPC ads.

1. Conversion Rate: No Changes

We’re used to seeing conversion rate changes during sale events, whether we’re talking about increases or decreases.

In 2022, the conversion rate stayed at the same level compared to the year 2021. The conversion rate did not change. It stayed at 11% for the entire time before, during and after Black Friday and Cyber Monday.

This can be surprising to some (or not!) – it simply depends on what you think about the circumstances.

Pro Tip

Review your own Black Friday and Cyber Monday sales performance! Here’s a Complete guide for Amazon sellers and vendors on how to conduct a review.

It also explains how to prepare and react during the sales events – maybe you’ll get some ideas to use in 2024.

Because the conversion rate is one of the biggest performance drivers, we decided it is important to present you with the data. Even though in 2022, around Amazon Black Friday, the conversion rate stayed at the same level.

2. How Amazon Sellers Made It Rain

Amazon PPC situation 6 months before Black Friday and Cyber Monday

To understand the whole picture, let’s first have a quick look at the Amazon PPC advertising situation around Prime Day (July 2022). The question is how active were Amazon sellers and vendors and how much did they invest in Amazon Ads before, during and after Prime Day?

According to our data, paid advertising around Prime Day got you more bang for your buck because the competition was not as high. More Amazon sellers and vendors decided to sit out the PPC advertising in that period (find out more about Amazon Prime Day 2022 insights).

Amazon PPC situation around Black Friday and Cyber Monday

Given what was the PPC advertising situation like around Prime Day (6 months earlier) you might be wondering: did Amazon sellers and vendors hold back with advertising on Amazon around Black Friday and Cyber Monday as well?

Definitely not! They went all in when it comes to PPC advertising and spent a shocking +25% more on Amazon Ads in November 2022!

But did it pay off? Keep reading to find out!

3. Fierce Competition in the PPC Game

Based on the data, either e-commerce businesses invested more in Amazon Ads, or much more Amazon sellers and vendors advertised in general.

Within our data, we can conclude that more money was spent with a smaller return.

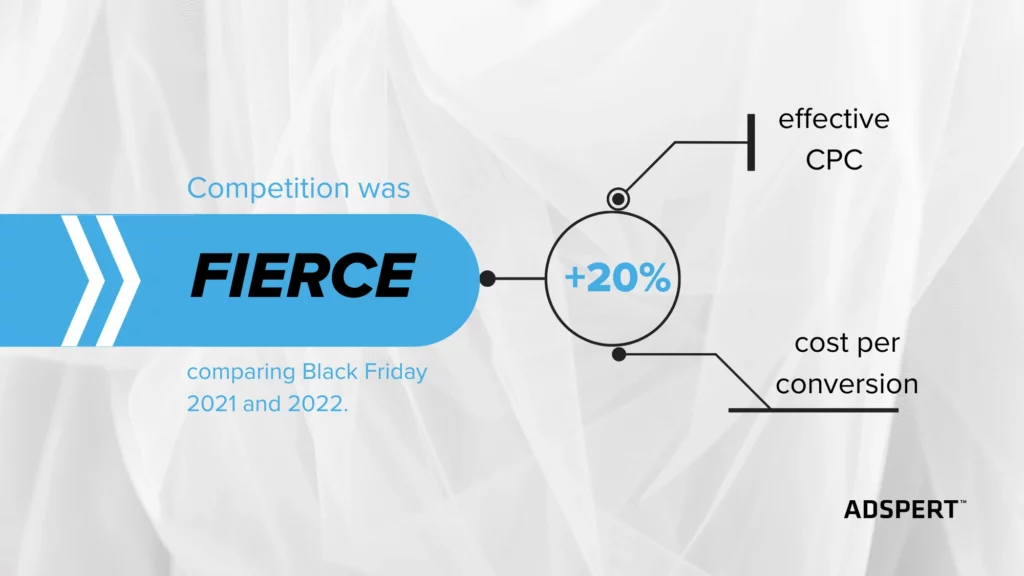

The not-so-good news? This led to an increase in cost per conversion. The cost per conversion increased by nearly +12%.

Advertisers Affected by 20% Higher ACoS

We also saw a significant increase in ACoS. In comparison with 2021, the ACoS was in fact 20% higher on Black Friday 2022.

Either way, Amazon PPC competition was fierce and more intense!

This year’s effective cost per click (eCPC) confirms this observation. On Black Friday, effective CPC was +20% higher, which goes along with a +20% increase in cost per conversion.

Thus, it is likely your advertising campaigns were less profitable at that time of year. So: did it make sense to increase the bids around Black Friday 2022?

It depends on what your goal was.

- If your goal was to get as much revenue as possible on Black Friday regardless of the ACoS, then yes, you should have increased your bids.

- If your goal was to reach your ACoS goal, it probably wouldn’t have made sense to increase the bids, because on that single day, you wouldn’t have reached the goal.

- If your goal was to empty your old stock and make room for new products or product updates, this was the best time to advertise them.

Amazon Black Friday 2022: Win or Lose for Advertisers?

A day like Black Friday was not the most profitable this year for Amazon pay-per-click advertising. If you scroll down and look at December numbers, it was probably much better to advertise then instead of in November during Cyber Week.

But here’s the kicker: this is something that you find out afterwards. It is impossible to predict how much competition there will be and what the KPIs will show.

One thing is for sure – Black Friday and Cyber Monday are two of the biggest and most popular sales events every year with shoppers and sellers alike. The chances to get a good return on your PPC ad spent are still high!

For any Amazon seller or vendor, it definitely makes sense to participate in the sales events, one way or another.

2022 Holiday Shopping Recap

Holiday deals and promotions are on every seller’s (and consumer’s) mind, especially at the end of every year. Running an eCommerce business or an Amazon store is not a piece of cake!

And investing in Amazon Ads or any other PPC advertisement can be a tricky decision because there is no guarantee of how well your ads will do – there are simply too many variables.

So how to overcome that? With knowledge! Keeping track of your PPC performance and the general market situation won’t give you direct results and guarantees. But it will bring you one step closer to understanding what’s going on and helping you make informed, data-driven decisions.

That’s why we analyzed numerous Amazon Ads accounts and prepared a recap of the entire holiday shopping season 2022. Read on to get the insights of the real situation in the Amazon market and use the learnings to support your Amazon Ads strategy in 2024.

When Is Holiday Shopping Season?

Holiday shopping refers to the holiday season in November and December. Besides Black Friday and Cyber Monday which take place in November every year, December is THE time for Christmas shopping.

To get the whole picture of the holiday shopping season, we analyzed data gathered from 1 November and December 2022.

When we speak about Christmas shopping, we compare data from December 2021 to December 2022.

Christmas Shoppers: the Cheaper the Merrier

The Black Friday and Cyber Monday sales numbers were encouraging for sellers as shoppers spent so much that it broke a record! At least in the United States where record online spending during Black Friday amounted to $9.12 billion (source: Adobe).

If they were ready to lighten their wallets during Cyber Week, then why not do the same with Christmas purchases?

There is one surprise: during Amazon Black Friday and Cyber Monday consumers bought products that are on average priced 4% higher. In December 2022, they concentrated on cheaper products!

Buy Cheaper, Buy More

Considering the economic circumstances I wouldn’t call it too surprising. We made the observation based on the conversion value which was -11% lower this December.

Plus we’ve already seen this behavior in 2022! In our Amazon Prime Day 2022 analysis, we came to the same conclusion: shoppers focused on lower-priced items AND at the same time broke the Prime Day all-time record.

So: buying cheaper products does not automatically mean that consumers buy less. Amazon Christmas shoppers repeated the Amazon Prime Day behavior – they focused on lower-priced items and bought more.

How much more in terms of Amazon PPC? Comparing December 2021 and 2022, the conversion rate for Amazon Ads increased by a head-spinning +24%!

Holiday Shopping: Amazon PPC Breakdown

Earlier we looked into the data and observations that revolve around Black Friday and Cyber Monday. Now it’s time to ‘marry’ the November findings with December 2022.

1. Amazon PPC Spend Soared by +25%

I already talked about how Amazon sellers and vendors spent +24% more on Amazon Ads in November around Black Friday and Cyber Monday. Did the trend continue in December, the month notorious for Christmas shopping?

Just like consumers, eCommerce businesses that sell and advertise on Amazon did not hold back. They not only maintained the same, almost one-quarter higher Amazon advertising budgets but poured even more money into it!

The numbers speak for themselves:

- November 2022: +25% ad spend increase

- December 2022: +26% ad spend increase

During the entire holiday shopping season (November and December 2022) sellers altogether spent +25% more on Amazon PPC! E-commerce businesses clearly saw the holiday season as THE time to pour more money into PPC advertising on Amazon.

2. Fierce Competition Continues

Earlier we saw that around Black Friday and Cyber Monday 2022 Amazon sellers and vendors went all out with Amazon PPC. The trend continued throughout December with 26% ad spend increase.

But what about effective CPC (eCPC)? Again, we are comparing the entire holiday shopping season. We observed a +6% increase in eCPC as well!

Note

Effective CPC or also known as eCPC is the cost per click after a campaign has started and generated clicks and cost. If your ads campaign generated 10 clicks and you spent 1€, your eCPC for this campaign is 0,10€.

This confirms the remark about Amazon sellers and vendors spending more on Amazon PPC in the holiday shopping season 2022 compared to 2021.

But here’s the kicker: spending more on PPC does not necessarily mean you’ll get the most out of it. What was the general outcome, did Amazon advertisers celebrate wins or count losses?

3. Sky-High Conversion Rate, Lower Cost per Conversion

You probably guessed it by now – I saved the best for the last. We will all remember the holiday shopping season 2022 as a time of high conversion rates combined with a lower cost per conversion!

In December 2022 the conversion rate skyrocketed. Which is amazing on its own, and even more so if you think about the economic circumstances. Here are the conversion rate numbers:

- December 2022: 12%

- December 2021: 9.7%

Conversion rate in December 2022 was higher by +24%.

As an Amazon advertiser, what else could you ask for? It almost cannot get better than that! But it does: cost per conversion was much lower as well:

- December 2022: Cost per conversion was lower by -17%

The only thing keeping our feet on the ground is the fact that we saw a lower conversion value in 2022 compared to 2021.

- December 2022: Conversion value was lower by -11%

But don’t let that spoil your good mood. Regardless of the lower conversion value, the conversion rate was extremely high paired with a significantly lower cost per conversion.

In a nutshell: if you advertised on Amazon this holiday shopping season, you quite likely popped a bottle of champagne afterward!

Final Thoughts

This year’s holiday shopping season (2022) wasn’t great only for consumers who snatched up a bunch of great deals.

The data shows that Amazon sellers and vendors who invested in Amazon PPC advertising came out as clear winners, especially in December.

Yes, there was more competition. But if you managed to get your foot in the door to Amazon PPC, you most likely saw a great PPC scenario. The average conversion rate was high (12%), and average cost per conversion was much lower than last year (-17%).

This almost ideal situation was slightly spoiled by lower average conversion value (-11%). Overall, Amazon sellers and vendors who did spend a part of their advertising budget on Amazon PPC, were most likely satisfied with the outcome.

I understand that you might be reluctant to invest in Amazon PPC in general. Optimizing PPC campaigns takes time, you might be afraid that ad campaign profitability will be (too) low and let’s be honest – it is difficult to determine the most efficient bids.

But you know what, you don’t need to do it all by yourself! Our smart AI will do all that (and much more!) for you. Start your free 30-day Adspert trial to maximize your profits and free up your time.